Arizona Withholding Percentage 2024

Arizona Withholding Percentage 2024. You can use your results from the formula to help you complete the form and adjust your income tax withholding. State income tax return due dates typically follow the.

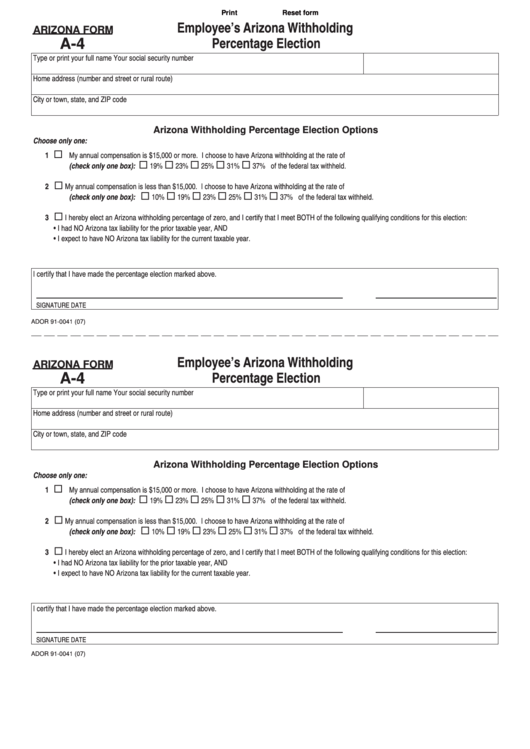

Check the 2024 arizona state tax rate and the rules to calculate state. Every arizona employer is required to make this form available to its arizona employees by january 31, 2023.

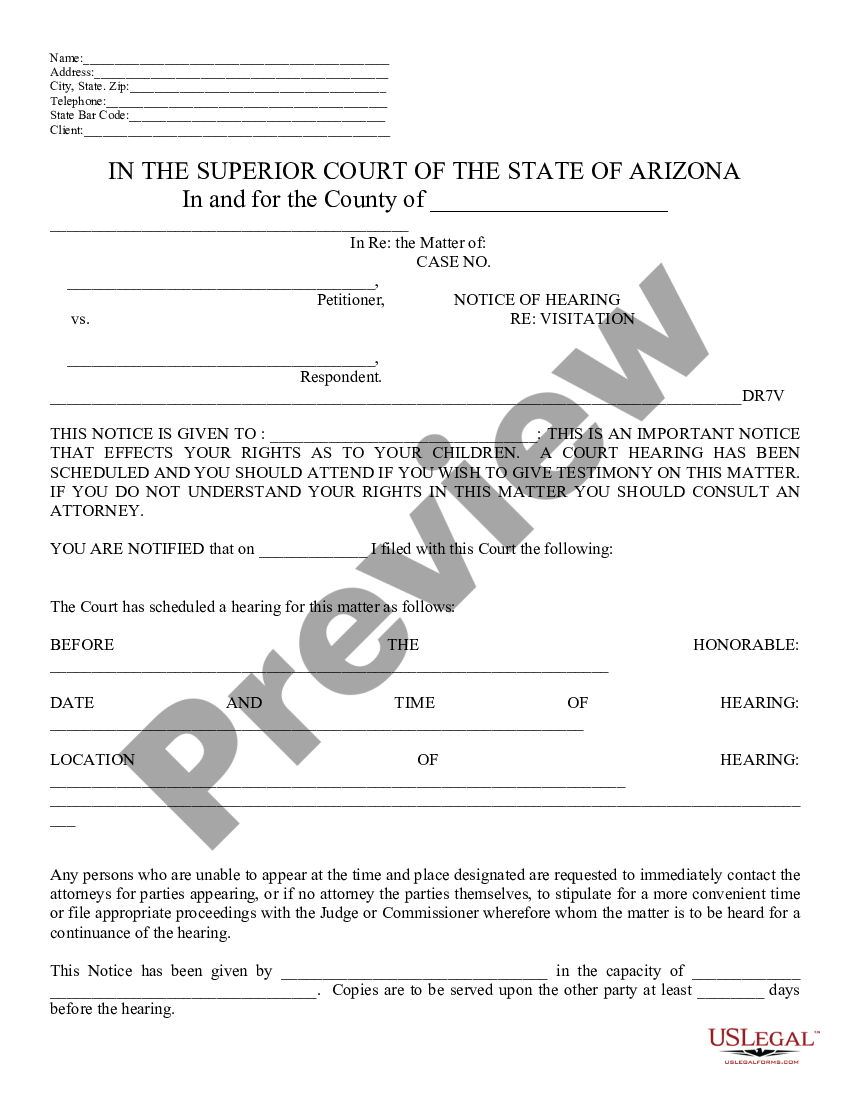

An employer must withhold arizona income tax from employees whose compensation is for services performed within arizona.

Arizona State Withholding Form 2023 Printable Forms Free Online, The az tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.). Calculating the exact amount is the employer’s (your) responsibility.

New A 4 Form 2023 Printable Forms Free Online, Your average tax rate is. Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona.

Forms A4, Enter your info to see your take home pay. You may also elect to have additional money withheld from your.

Az State Tax Withholding 2024 Cecil Daphene, Arizona has a flat income tax rate of 2.5%. You may also elect to have additional money withheld from your.

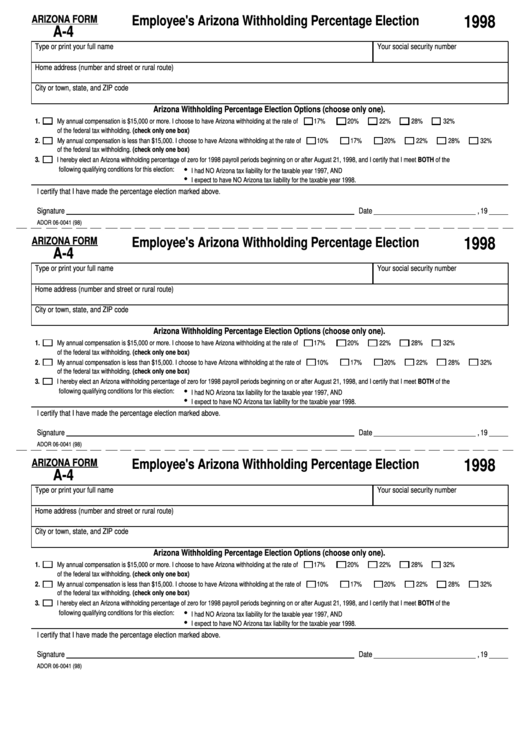

Free Arizona Form A4 (2013) PDF 30KB 1 Page(s), This rate applies to taxable income earned in 2023, which is reported on 2024 state tax returns. Arizona has a flat income tax rate of 2.5%.

What Is the Best Percentage for Arizona Withholding, Your average tax rate is. Request for reduced withholding to designate for tax.

Did The Federal Withholding Change For 2024 Ilise Leandra, As of january 1, 2023, the new default withholding rate for the arizona flat income tax is 2.0%. The withholding percentage can be calculated as follows:

2024 Tax Brackets And How They Work Ericka Stephi, The arizona tax calculator is updated for the 2024/25 tax year. Calculating the exact amount is the employer’s (your) responsibility.

Form A1r Arizona Withholding Reconciliation Tax Return 149, Now, the department states that the tax rates to be. Smartasset's arizona paycheck calculator shows your hourly and salary income after federal, state and local taxes.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage, The arizona tax calculator is updated for the 2024/25 tax year. You're not required to submit a new a4 unless you don't want the standard tax rate:.

Every arizona employer is required to make this form available to its arizona employees by january 31, 2023.